Why Silicon Valley VCs rely on Unique Tech Propositions for Startup Scouting

How successful investors spot and evaluate early-stage UTPs

William Orton must have been a smart businessman and advocate of innovation. As Vice President of the then-emerging Western Union Telegraph Company, he oversaw the expansion of WU’s telegraph network across the United States in the 1860s. Under his leadership, the speed and reliability of telegraphic communication improved dramatically. However, the one thing he will be remembered for forever is turning down one of the greatest business opportunities of all time.

The patent, registered one year earlier in Salem, Massachusetts, that he was offered to buy for $100,000 in 1877 had the USPO number 174465. After reading through the paper, he made his decision with the words, “Why would any person want to use this ‘toy’?” The name of the patent owner was Alexander Graham Bell. The invention was called the telephone.

Would Orton have made a different decision if he had understood the disruptive technology potential and evolution of converting sound waves into electrical signals and direct voice transmission? Probably. Two years later, Orton was willing to offer $25 million for Bell’s patent. But it was too late.

There are similar missed opportunity stories from Apple (underrated technology: bitmapped graphics) Facebook (scalable server infrastructure) or Netflix (adaptive bitrate streaming).

The Power of Technology Insights

Identifying and understanding the technology of early-stage tech startups with high traction and exit potential is crucial for every investor and venture capitalist. One of the most powerful signals VCs can use to spot this potential is the Unique Tech Proposition (UTP). Understanding and leveraging UTPs can give investors a significant edge in discovering the next wave of groundbreaking technologies.

Based on knowledge shared with us by Silicon Valley VCs, let's delve into what a UTP is, how to spot and evaluate one, and how the most successful investors assess its potential.

1. What is a Unique Tech Proposition (UTP)?

A Unique Tech Proposition (UTP) is a technological solution or innovation that stands out in the market due to its originality, effectiveness, and potential impact. UTPs are the distinguishing factors that make an early stage startup's technology special and competitive. In the venture capital world, identifying a strong UTP is crucial for successful startup scouting and investment. By analyzing Unique Tech Propositions, VCs can better predict which startups are likely to succeed in the fast-paced tech landscape.

2. How to Spot a Unique Tech Proposition

Spotting a UTP requires an experienced eye for innovation and technology trends. Here’s how skilled VCs identify them:

Identification Criteria:

Innovation: Evaluate whether the technology introduces novel methods or significantly improves existing solutions.

Uniqueness: Assess if it offers something unique that competitors cannot easily replicate, providing a competitive edge.

Feasibility: Evaluate whether the technology can realistically be developed and implemented.

Industry Relevance: Ensure the proposition addresses pressing needs and use cases of certain markets.

Research and Sources:

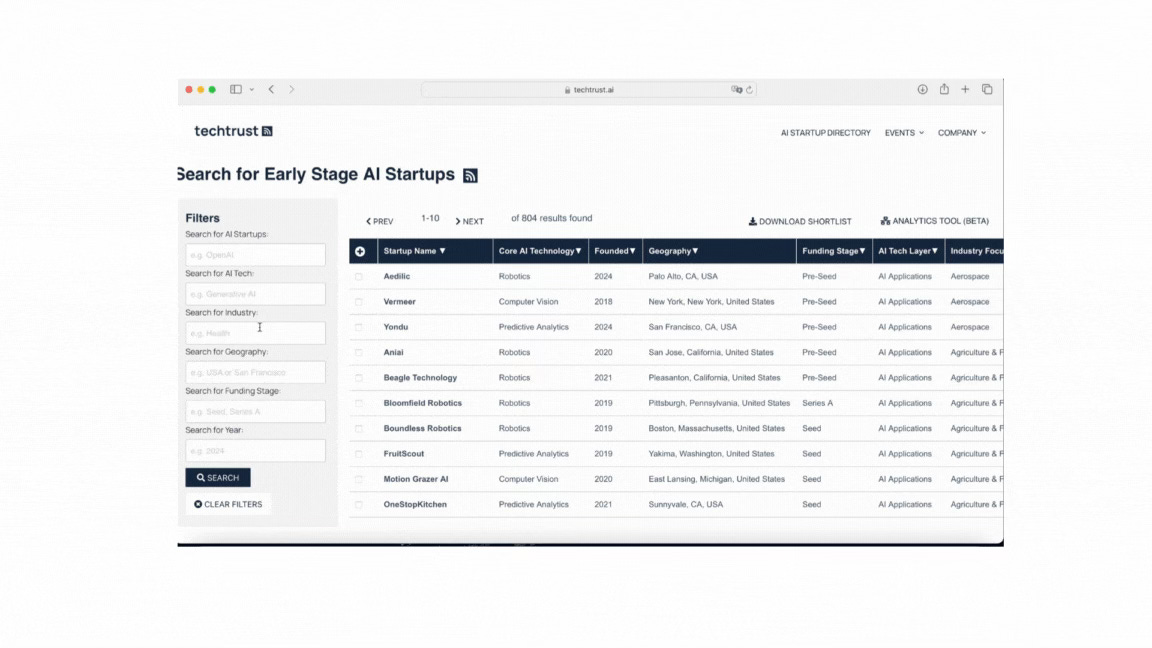

Startup Directories & Search Tools: Checking dedicated scouting-tools like techtrust.ai or general directories like Crunchbase regularly to stay updated

Industry Reports: Reviewing industry reports to stay updated with the latest trends and innovations.

Tech Conferences & Demo Days: Attending events where startups present their groundbreaking technologies.

Academic Publications: diving into academic journals for emerging studies and innovations.

Networking:

Engage with Technology Experts: Building relationships with technology experts to gain insights into promising, emerging tech.

Connect with Founders: Interacting with startup founders to stay informed about new technology developments.

Collaborate with Other VCs: Sharing technology knowledge and opportunities with other venture capitalists.

3. How to Evaluate a UTP

Once a potential UTP is identified, evaluating its viability and potential is crucial. Here are some methods shared with us by VCs and angel investors:

Evaluation Metrics:

Degree of Innovation and Uniqueness: Assessing the novelty and groundbreaking nature of the technology.

Competitive Tech Landscape: Analyzing the competition and the startup's unique advantages.

Market Demand: Evaluating the potential market size and demand for the solution.

Technical Feasibility:

Development Stage: Reviewing the current stage of development and future milestones.

Intellectual property (IP) & Technical Soundness: Ensuring the technology is based on solid scientific and engineering principles.

Team Assessment:

Expertise: Evaluating the founding team's expertise and track record in the relevant field.

Execution Capability: Assessing the team's ability to bring the technology to market.

Risk Analysis:

Technical Risks: Identifying potential technical challenges and feasibility issues.

Market Risks: Considering market acceptance and adoption challenges.

Financial Risks: Assessing the financial requirements and sustainability of the technology.

4. Summary

Unique Tech Propositions are critical in startup scouting and early-stage investing. By understanding what a UTP is, knowing how to spot one, and learning how to evaluate its potential, VCs can significantly enhance their ability to identify high-potential startups. The methods shared above can help increase the likelihood of spotting the next unicorn and startups with alpha potential.